By: Geeq on Jun 19, 2023

Algorithmic Monetary Policy for a Stabilized-Token1

Table of Contents

1.Introduction

Geeq is a new approach to distributed ledger technology (DLT). Geeq’s proprietary protocol, Proof of Honesty (PoH), provides a multilayered security guarantee based on economic mechanism design, that extends to the entirety of the Geeq Platform. Each instance of a GeeqChain has a validation layer with its own blockchain and ledger, its own independent network of validating nodes, and a separate application layer which may be customized to meet the requirements of a wide variety of use cases.

The “$GEEQ” (the platform’s native token) is primarily intended to pay the networks of nodes for their validation and virtual machine services. $GEEQs can also be used for micropayments in IoT, content management, smart city, and other applications, or as a general purpose cryptocurrency.

This white paper proposes a new approach to monetary policy on digital platforms with a utility token. Based on centuries of lessons learned from fiat economies, digital platforms offer new opportunities to commit to transparent, predictable, algorithmic monetary policies designed to let platform use and token demand – rather than speculation – be the primary drivers of token value.

Importantly, this monetary policy does not contemplate fixing token price or zones of engagement at any point. The token price and zones of engagement float with the market. In fact, allowing market fundamentals to determine prices is the reason we explore ways to diminish sources of noise.

1.1 The Volatility of Cryptocurrencies Limits Blockchain Adoption

Blockchain has enormous potential to create new markets, make existing markets more efficient, and protect and empower ordinary people.2 Unfortunately, the price volatility displayed by existing cryptocurrencies has had the effect of making the public wary of blockchain technology and platforms in general. Token prices seem to be, and often are, driven by speculation and market manipulation. This may be true even for good projects with dedicated teams building important applications.

Rational users naturally insist on a premium to buy and hold such risky assets, which further depresses their values. To make matters worse, both positive and negative price swings can be driven by relatively small trading volumes which can take on a life of their own once they start.

Speculation and volatility are familiar problems in finance and economics. Theory and historical experience have many lessons to teach about what a well-designed monetary policy can achieve. Allowing any currency, fiat or crypto, to become detached from its underlying utility to the economy puts speculators squarely in charge of determining its value. The result is volatility and possibly monetary collapse, none of which benefits token holders, platforms, application developers, or users in the distributed ledger technology (DLT) space.

1.2 Stable-Coins and Exchange Rate Pegs

If it were possible to create a “stable-coin” that had a fixed value with respect to fiat currencies, it would probably relieve a great deal of the public’s concern and anxiety about using cryptocurrencies. The idea of maintaining fixed exchange rates between currencies has a long history in economics and policy. Central banks of many nations have often attempted to peg the value of their own currencies to another, to a basket of other currencies, or to a commodity such as silver or gold. Banks support these pegs by standing ready to buy back any domestic currency offered at the promised exchange rate. Unfortunately, policies that have attempted to fix the relative value of a currency either through foreign exchange pegs or stable-coin approaches have been difficult, expensive, ill-advised, and almost always unsuccessful.

For example, in the early 1990s, England attempted to maintain a 2.7 mark/pound exchange rate as part of its effort to support the European Exchange Rate Mechanism. George Soros and other currency speculators shorted the pound forcing the Bank of England to raise interest rates and commit large parts of its foreign exchange reserves to buying back the pound on the open market. This became increasingly difficult as the Bank of England’s reserves dwindled. Ultimately, England was forced to give up and let the exchange rate float. Currencies backed by commodities such as gold or silver have also proven to be unsustainable. The underlying economics here is that the one and only way to support a fixed exchange rate is to maintain a 100% reserve of the other currency or commodity in question.3

True stable-coins also have an obvious downside from the standpoint of platform builders. Namely, if 100% of token sale revenue is kept in reserve to guarantee the value of the stable-coin, nothing is left over for platform development. In addition, the lack of any upside removes all incentives for potential buyers and/or token holders to purchase or keep the token of a stable-coin project.

1.3 Lessons for Tokenomics

The bottom line is that a bad monetary policy can destroy a platform’s utility just as easily as it can destroy a nation’s economy. Both extremes, whether uncontrolled volatility or costly and infeasible stable-coin policies, are counterproductive and unsustainable. When implemented without regard to fundamental utility, poorly thought out tokenomics can create self-inflicted, self-fulfilling, and near-fatal damage to platform adoption.

What Geeq seeks is a monetary policy that is predictable and creates expectations that reduce price volatility, without attempting the impossible task of controlling the market. This monetary proposal for a stabilized token – not a stablecoin – was developed with those objectives in mind.

In this paper, we describe an Algorithmic Monetary Policy (AMP) that would provide users information about how $GEEQ’s token supply is related to platform usage. The ability to introduce transparency is one of the most important steps that digital economies can take. The AMP would put that innovation to good use by providing far more information about token supply than citizens usually have about fiat supply will change in response to global economic conditions.

The AMP would specify incremental, partial, and algorithmically determined expansions and contractions of the tokenbase in response to the token’s market conditions. In effect, this policy would help to create a “stabilized-token” that, when triggered, works to protect token value from rapid price changes driven by changes in price in thin markets or artificially induced, large changes that are unrelated to actual token utility.

2. Predictable Standing Orders Would Dampen Price Movements at Extremes

Geeq has proposed the use of smart contracts with the idea that predictable standing order books will provide users with the ability to form rational expectations when they might otherwise be emotionally charged by token prices near all time highs or lows. The intention is to make the state of Geeq’s order books transparent so users know there are some buffers in place to stabilize prices at the extremes.

This algorithmic monetary policy is emphatically not a proposal to control the token price level. Geeq’s technology, platform, and services seek to provide market solutions and opportunities for growth where there have been market failures and barriers to access. Consistent with those goals, this paper explores the dynamics of implementing a fully transparent policy with two self-funded reserves (one for tokens, one for fiat), that works within conditions set by the market itself. Once again, the purpose is to diminish the role of rumors, speculation, and uncertainty in order to allow users to focus on platform use as the primary driver of token value.

3. Prior Communications

The Geeq team has communicated clearly that, if there is a decision to implement a proposal with a framework like the one discussed here, it would be no sooner than a year post-mainnet. As discussed by Geeq Co-Founder and Chief Economist John Conley here, this is a policy proposal with many perceived benefits. However, policy and parameters are an attempt to provide a situation better than the alternative. It could be that the AMP is never implemented.

We provide a high level description and example of an Algorithmic Monetary Policy for a stabilized token. The numerical example that follows is one of convenience and was chosen so it works out arithmetically, for those inclined to check the math. It is easier to discuss benchmarks of $0.25, $1.00, units of a penny, 25%, 50%, and so on. Assumptions for this modeling exercise are stated clearly below.

2.1 Overview

A total of 100M $GEEQs with a notional base price of $.25 has been pre-mined. They are sold or otherwise distributed to token holders, contributors, founders, the community, or reserved for platform development according to Geeq’s tokenomics.

The concept behind this Algorithmic Monetary Policy (AMP) is to slowly expand the tokenbase as $GEEQ’s price goes above a base price, P0, to generate a cash reserve that will be used to support $GEEQ’s price if it should ever start to decrease. The AMP itself uses this to create a non-trivial and predictable base of supply and demand for $GEEQ at every price level that should insulate $GEEQ from fluctuations that result from thin trading volumes.

Operationally, the AMP generates new tokens at a rate of 10% for every multiple of the base price of $.25 that $GEEQ’s price goes up. Part of the revenues generated from the sale of these new tokens is placed in escrow in a Fiat Stabilization Reserve (FSR) account. As long as $GEEQ’s value goes up, both the tokenbase and the FSR go up as well. If $GEEQ’s price ever begins to fall, the FSR account automatically starts buying back a predetermined, publicly known, number of tokens and places them in a Token Stabilization Reserve (TSR) account which removes them from the

circulating coinbase.

Overall, 45% of any new $GEEQs issued will be set aside for token value stabilization, 30% for development, sales and other platform expenses, 15% for founders advisors and contributors, and the remaining 10% for developer support and community outreach. This is consistent with the Geeq for-profit business model of sharing benefits and costs across the community and contributors to align incentives to participate. As for monetary policy, the AMP uses the funds in the FSR for stabilization in three separate price defense zones.

High Water Zone (HWZ): 25% of the FSR is used to stabilize the $GEEQ’s value from the highest price it has ever obtained (called the high water price or all time high ATH) to 90% of that value. This is because the greatest volatility exists close to the current equilibrium price. To put this another way, 1% variations in price are more common than 5% variations, which are more common than 10% variations, and so on. Day over day price increases and decreases of 15% or 20% are not unheard of for cryptocurrencies, but they are far less frequent than smaller variations. As a result, a disproportionate share of resources is devoted to stabilization at the top 10% of the token valuation range. Heading off price drops while they are small is also a much more efficient way to use reserves than letting such fluctuations build and start generating negative expectational feedback.

Middle Price Zone (MPZ): 50% of the FSR is used to stabilize the $GEEQ’s value if prices should ever leave the HWZ. In the MPZ, the monetary policy is designed to provide certainty that demand for the $GEEQ exists at all price levels and thereby serve as a speed bump to slow or stop price drops. Often, such price drops are built on very thin trading volumes rather than a wholesale loss of confidence in a currency. In such cases, the offer to buy back non-trivial quantities of tokens (although not a large fraction of the total coinbase) can have a disproportionate impact on price levels.

Price Floor Zone (PFZ): 25% of the FSR is used to guarantee a minimum value or price floor for $GEEQ. The price floor also represents the lower bound of the MPZ. Where this is set depends upon the size of the FSR and TSR. The details of how the price floor is calculated are discussed below.

To summarize, Geeq’s AMP4 creates a predetermined, publicly known, additional supply of tokens in bull markets, and additional demand in bear markets by using the FSR to repurchase tokens and remove them from circulation. The size of the circulating tokenbase is therefore automatically adjusted to reflect the actual needs of the users of the platform. This does not prevent the $GEEQ’s value from increasing, nor does it guarantee that its value will never fall. What it does is fund a kind of insurance policy in good times that can be deployed to reduce the impact of bad times. The fact that there is a prefunded commitment to defend $GEEQ’s value can dampen or stop low-information expectations driven price changes as well as make it much more difficult for speculators to manipulate $GEEQ’s value.

2.2 An Example of the AMP at Work

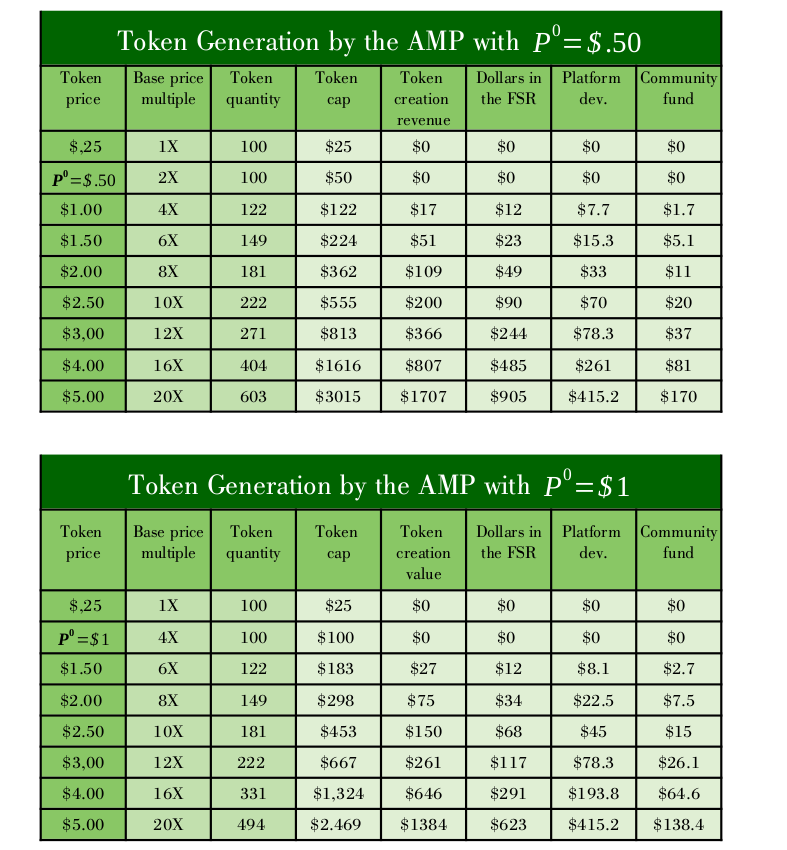

To get a sense of how Geeq’s stabilization policy works in practice, the following tables show examples of how the AMP could operate, starting from two possible original prices, P0=$.50 and P0=$1.00.5 These are mathematical examples adopted for convenience of explanation.

For simplicity, the tables assumes that price of $GEEQ at mainnet launch increases monotonically to $ 5.00. If prices were to follow a more complicated path of upward and downward volatility, the only thing that would change is that the FSR would be somewhat higher (the reason is discussed below). See the mathematical appendix at the end of this document for more details on how these numbers were calculated.

These tables illustrate the token creation aspect of the AMP. The central purpose of Geeq’s monetary policy, however, is price stabilization which this token creation makes possible. The following is an example to illustrate how the policy accomplishes this goal assuming that the original price used for the AMP is P0=$1.00.

First, suppose that $GEEQ’s price starts to rise from P0=$1.00 For every multiple of $GEEQ’s base price of $.25 above P0, new tokens are created at a rate of 10%. This means that new tokens are generated at a rate of 0.4% for each penny that $GEEQ’s fiat value rises above P0. Thus, if the price of $GEEQ goes to $1.01, a total of (.004)100M =400k new $GEEQs are created, if it goes up by another penny to $1.02, an additional (.004)100.4M =401.6k new $GEEQs are created, and so on. Suppose that price continues to increase until it reaches $5.00. Then a total of $623M would have been added to the FSR to defend $GEEQ’s price.

Second, suppose that $GEEQ’s price starts to decrease from this high water price of $5.00. One quarter of the FSR or $156M is deployed in equal amounts over the 50 one cent intervals from $4.99 (one cent below high water price) to $4.50 ( 90 % of the high water price) in the HWZ. If $GEEQ’s price falls all the way to $4.50, a total of approximately 33M $GEEQs would have been repurchased and placed in the TSR leaving 494−33=461M in circulation.

Third, suppose that $GEEQ’s price continues to fall into the MPZ. The AMP deploys 50% of the FSR to defend $GEEQ’s price over the range of $4.49 to one cent above the price floor. It will turn out that we can set the price floor at 52¢ in this case. This means that the MPZ has 396 one cent price intervals between $4.49 and $.53 and so deploys 311.5 /396=$787k to repurchase tokens in each. Suppose that $GEEQ’s price drops all the way to the price floor. In total, the AMP would have repurchased 167M tokens. This implies that approximately 461−167=294M tokens remain in circulation and so the TSR holds 33+167=200M $GEEQs.

Finally, the AMP deploys 25% of the FSR in the PFZ as an offer to buy any number of $GEEQs from users at the price floor. To see that a price floor of 52¢ is feasible in this case, note that the AMP has $156M to use in the PFZ which allows it to buy up to 156/.52=300M $GEEQs, that is, slightly more than the 294M $GEEQs remaining in circulation. Interestingly, this means that the AMP ends up offering price floor for $GEEQ that it is higher than $GEEQ’s 25¢ issue price in this case.

So far, we have explored what would happen if $GEEQ’s price rose monotonically from P =$1.00 to a high water price of $5.00 and then fell monotonically to the AMP’s price floor of 52¢. Let’s continue the example with $GEEQ’s price rising again to $5.00 and then beyond.

Starting from the price floor, the AMP stands ready to both to buy any tokens still in circulation, and sell any tokens in TSR, at 52¢. Suppose that $GEEQ’s price started to rise again into the MPZ until it reached $4.50, the top of the MPZ. The AMP sells an equal share of the 167M the tokens it purchased in the MPZ at each of the 397 one cent intervals between $.53 and $4.50. Thus, it sells 167/397=422k tokens at each price level. This generates a revenue of $419M. Note that this is more than the 622/2=$ 311.5M that the AMP spent purchasing these tokens and so a profit of $ 108.5M is made in the MPZ.

If $GEEQ’s price continues to rise to the original high water price of $5.00 , an equal share of the 33M tokens purchased in the HWZ are sold at each of the 50 one cent intervals between $4.51 and $5.00 , or 660k tokens in each. In total, this generates approximately $157M in revenues which is $1M more than the $156M that was spent acquiring them. The profits are much smaller than in the MPZ, but the principle is the same.

If $GEEQ’s price goes above its old high water price, three things happen. First, all of the profits made by the AMP are added to the FSR. Thus, at $5.01, the FSR is reset and contains $623 + $106.5 + $1 = $730.5M. Second new $GEEQs are issued at a rate of .4% per cent as long as price continues to go up. Finally, the high water mark price is reset at the point that $GEEQ’s price price starts to decrease again. The AMP would then start to buy back tokens as outlined above only from a new high water price and with a larger FSR.

A key element of the AMP is that it produces a fiat surplus. This is because an equal share of the dollars in the FSR are spent buying $GEEQs on the way down, but an equal number of $GEEQs are sold on the way back up. Thus, many more $GEEQs are purchased at lower prices than at higher prices on the way down, while an equal number of $GEEQs are sold at all prices on the way up.

This implies that the more volatility $GEEQ experiences, the more effective Geeq’s monetary policy becomes in the future. As we see above, the AMP generates a surplus as prices move up and down. The result is the FSR grows in proportion to the tokencap, greater resources are deployed to support prices in each of the price defense zones, and the price floor that the AMP generates for $GEEQ increases.

Geeq’s monetary policy proposal of dual reserves is pre-funded, transparent, and is designed to smooth the volatility and reduce uncertainty. The policy would not, in and of itself, determine the $GEEQ’s market price. Instead, the AMP stands ready with a set of known bids and asks that all platform users can take into account when planning and conducting their business.

3. Conclusion

This paper has explored a proposal for an Algorithmic Monetary Policy, centered on the idea of creating a middle path between the impracticability of a fixed exchange rate stable-coin, and the uncertainty and volatility of an unsupported, free-floating token. The main purpose of the $GEEQ is to pay the network of nodes that support multiple, interoperable instances of GeeqChains for their validation and virtual machine services. The intention of Geeq’s monetary policy is to tie token value more closely to its use on the platform and the value of the services built by developers within the ecosystem of the Geeq Platform. Limiting the impact of speculators and dampening the impact of fear, uncertainty, and doubt creates a more predictable and stable environment to support and sustain adoption and usage for all of Geeq’s platform participants.

See the example on page 9 in the mathematical appendix (in the .pdf version of the paper) for details on how these numbers were calculated.

Photo by Daniel Watson from Pexels

Disclaimer

The details of the rounds, liquidity and monetary policy, tokenomics and distribution may change depending upon conditions in the current regulatory, financial, and legal environment, agreements with liquidity providers, coding and other technical considerations. New information will be published here. Tokenomics and distribution will not change following the conclusion of the pre-round allocation.

Notes

- This paper contains a description Geeq’s stabilized-token and the monetary policy that supports it. Geeq, GeeqChain, Geeqosystem, Proof of Honesty, PoH, Strategically Provable Security, SPS, Catastrophic Dissent Mechanism, CDM, Stabilized-coin, and Stabilized-token are all trademarks of The Geeq Corporation.

- See, for example, a portion of a report written for the World Bank posted here:https://medium.com/geeq-official/world-bank-using-blockchain-to-further-its-mission-9a4f12fde51a

- These problems are elaborated by Geeq’s Chief Economist, John P. Conley, here: https://medium.com/@JPConley/etfs-rule-stablecoins-drool-how-to-make-cryptocurrencies-go-mainstream-b713a054b311

- The objective is to implement Geeq’s monetary policy through a smart contract. However, the policy requires interactions between real world banks, token exchanges, and Geeq users. While Geeq can and will make implementation of this policy transparent, regulatory and technical issues may place limits on fully automating the policy through a smart contract. Geeq’s founding principle is that code is law, and so to the extent that it is practical and compliant, an automatic process will be used. Banking and exchange fees, transactions costs, and similar expenses will be deducted from the FSR as they are realized.

- Of course, Geeq’s original price could be higher or lower when then mainnet is launched. See the appendix for a formal mathematical description that accounts for these details.

- These tables show the revenue that would be generated if all tokens were sold at the moment they were created. In fact, 85% will be sold immediately. Founders and advisors’ tokens are subject to lockups and may be held instead of forced onto the market directly as they are created.

To learn more about Geeq, follow us and join the conversation.

@GeeqOfficial